India’s apex industry body for alternative assets, the Indian Venture and Alternate Capital Association (IVCA), today announced the launch of #AltCap101 – a premier knowledge-sharing programme for fund managers in alternate capital.Organised in collaboration with IC Universal Legal, Advocates & Solicitors (ICUL) and EY India, this advanced learning platform will provide strategic insights to seasoned and emerging fund managers, helping them navigate the dynamic world of alternate capital. Built upon the success of IVCAs #VC101 in 2023, #AltCap101 is the next step in IVCA’s mission to provide insights and training forsenior partners in the alternate capital ecosystem.

#AltCap101 By IVCA to Empower Fund Managers with Alternate Investment Strategies

Scheduled to take place on 17th October 2024 in Mumbai, this specialised learning and knowledge-sharing programme will bring together Senior Management teams and CXOs of venture capital funds (VCs), micro-VCs, private equity (PE) funds, institutional investors, family offices, corporate venture capitalists (CVCs), and limited partners (LPs). For fund managers looking to make gains in alternate capital, this is an unparalleled opportunity to network with stalwarts of the financial ecosystem. It comes at a pivotal moment, as India’s alternate capital industry has been undergoing a remarkable transition. According to industry estimates, over the past decade and a half, India’s private capital assets under management (AUM) has more than tripled, reaching a record $124.3bn by the end of 2023.

Rajat Tandon, President, IVCA, placed emphasis on the programme’s importance as success in today’s alternate capital landscape demands more than just technical expertise, “#AltCap101 is designed to equip fund managers with a comprehensive understanding of the ecosystem, while providing a deep dive into the resources needed to thrive in todays financial landscape. The sessions, led by subject matter experts, will cover topics such as leveraging technology and AI in fund management, and conducting due diligence for effective risk management. Participants will move beyond the basics, gaining actionable insights into the alternate capital space, positioning India as a global hub for fund management.”

Tejesh Chitlangi, Joint Managing Partner, ICUL highlighted the importance of the timing of the programme, “#AltCap101 is designed to practically explain the finer nuances of the plethora of changes the Indian as well as global legal-regulatory regimes have undergone over a short span of time. Regulators expect letter as well as in-spirit compliances by the Funds and the GPs need to be absolutely on top of these frequent developments as the same would be critical from a risk management/mitigation perspective. Also, navigating the ever-evolving dynamics of the LP-GP relationships, exploring innovative fund structures need careful examination and strategizing. All these and many more topics in the form of practical examples and case studies will be discussed during the programme, which should benefit the entire Fund eco-system.”

#AltCap101 by IVCA will include advanced modules on critical topics such as navigating regulatory frameworks, leveraging technology and artificial intelligence (AI) for fund management, internalising versus externalising fund strategies, mastering due diligence and risk management, and much more. By attending immersive seminars led by industry leaders, participants will gain actionable perspectives on rising governance standards, the implications and importance of negotiating legal and commercial mandates, and the latest developments in this fast-moving industry.

Vivek Soni, Partner & National Leader – Private Equity Services, EY India said, “#AltCap101 has been designed as a key experience for fund management professionals seeking to excel in the rapidly evolving Indian alternate capital landscape. In today’s environment, investment success requires more than the technical know-how; it demands a good understanding of governance, portfolio management, and the effective integration of technology and AI for better PE/VC fund management. As India’s alternate capital markets grow in significance, this program seeks to equip fund management professionals with the essential tools and knowledge to stay ahead. By leveraging insights from industry leaders and engaging with real-world case studies, #AltCap101 offers a unique opportunity to learn from experts in the field, ensuring that participants are prepared to tackle the challenges of tomorrow.”

The event will feature an impressive lineup of speakers, including, Smt Nivruti Rai, MD and CEO of Invest India; Ashley Menezes, Chairperson IVCA and Partner & COO, ChrysCapital Advisors LLP; Saurabh Agarwal, Founder and Managing Director, Altstone Capital; Sudhir Variyar, MD & Deputy CEO, Multiples PE; Neha Grover, Regional Lead-IFC, South Asia Funds Group, International Finance Corporation (IFC) and Vineet Rai, Founder & Vice Chairman, Aavishkaar Group.

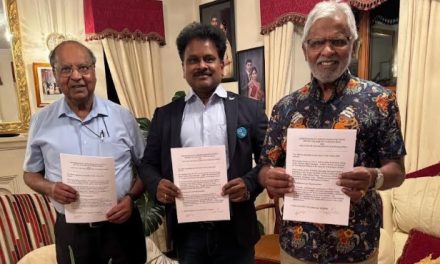

Industry leaders who are a part of the prestigious IC Universal Legal, Advocates & Solicitors (ICUL), namely Tejesh Chitlangi, Joint Managing Partner, ICUL; Sambhav Ranka, Senior Partner, ICUL; Leelavathi Naidu, Partner, ICUL; Sushreet Pattanayak, Partner, ICUL; Puneet Shah, Partner, IC Universal Legal (ICUL), Sanchit Kapoor, Partner at ICUL; and Twinkle Dhamecha, Partner, ICUL, will present their perspectives on the alternate capital space.

Representing EY India at the event will include: Vivek Soni, Partner and National Leader, EY India; â Santosh Tiwari, Partner, EY-Parthenon India; Prashant Garg, Partner, Technology Consulting, EY India; Ashish Kakwani, Partner, EY-Parthenon India; Subramaniam Krishnan, Partner, EY India; Nachiket Deo, Partner and National Leader, Private Equity Tax, EY India; Ashish Singhal, Partner, Transaction Diligence, EY India and Sheetal Garg, Partner, Strategy and Transactions at EY India

Rajat Tandon, President, IVCA and Amit Pandey, Lead: VC Ecosystem and Capacity Building, IVCA will also be a part of the summit and share their expertise in the discussions.

A one-of-a-kind opportunity to explore the alternate capital landscape, #AltCap101 by IVCA will feature real-world case studies and scenario-based learning, equipping participants with practical insights to address challenges within this evolving sector.

About IVCA – Indian Venture and Alternate Capital Association

The Indian Venture and Alternate Capital Association (IVCA) is a not-for-profit, apex industry body promoting the alternate capital industry and fostering a vibrant investing ecosystem in India. IVCA is committed to supporting the ecosystem by facilitating advocacy discussions with the Government of India, policymakers, and regulators, resulting in the rise of entrepreneurial activity, innovation, and job creation in India and contributing towards the development of India as a leading fund management hub. IVCA represents 46% of overall AIFs in the country, and its members are the most active domestic and global VCs, PEs, funds for infrastructure, real estate, credit funds, limited partners, investment companies, family offices, corporate VCs, and knowledge partners. These funds invest in emerging companies, venture growth, buyouts, special situations, distressed assets, and credit and venture debt, among others.